RATE CUT TO TREAT THE CORONAVIRUS?

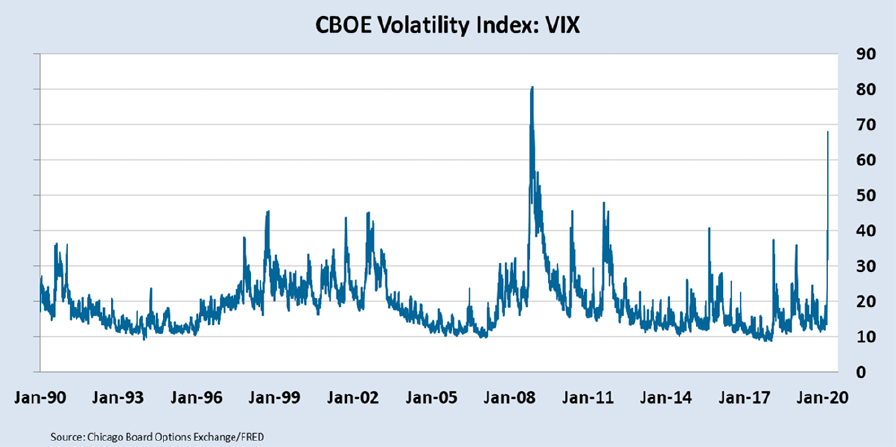

As the COVID-19 outbreak has spread rapidly around the globe (and within the U.S.) in recent weeks, the Chicago Board Options Exchange Volatility Index (VIX) has spiked to levels not seen since 2008, when world markets and economies infamously suffered a lot of pain before stabilizing. The VIX for March 12 is shown above.

Commonly dubbed “the fear index,” the VIX utilizes options prices to gauge expectations of future market volatility to offer guidance to participants understandably anxious to know both how long the instability may last and how bad it could become. As long as the coronavirus continues to wreak havoc on world health and chill all varieties of economic activity, the surge in this particular index is likely to last. Indeed, developments in the broader U.S. society over the past 24 hours—including the prohibition on incoming flights from mainland Europe, closure of numerous K-12 schools and universities throughout the U.S., suspension of the remainder of the NBA season, and announcement of positive coronavirus tests by actor Tom Hanks and his wife—may be reflected in the VIX before long.

On the other hand, that the VIX is currently reminiscent of 12 years ago does not necessarily suggest that a repeat of that scenario is inevitable. As President Trump said last night in his televised address, the present situation, unlike that one, is not a financial crisis and the country’s economic fundamentals remain strong. The volatility may persist across markets and continue to slow growth in many economies around the world over the coming weeks and months, but that trend could dissipate as quickly as it has grown. Once human ingenuity has prevailed over this threat, as it has over similar ones throughout history, the fear should subside and the fever will break.