COVID-19 SAPS U.S. ENERGY DEMAND

As the coronavirus continues to force temporary shop closures and mass telecommuting across the country, grid operators have generally seen energy usage fall across the board. However, the magnitudes of those drop-offs have varied considerably by region.

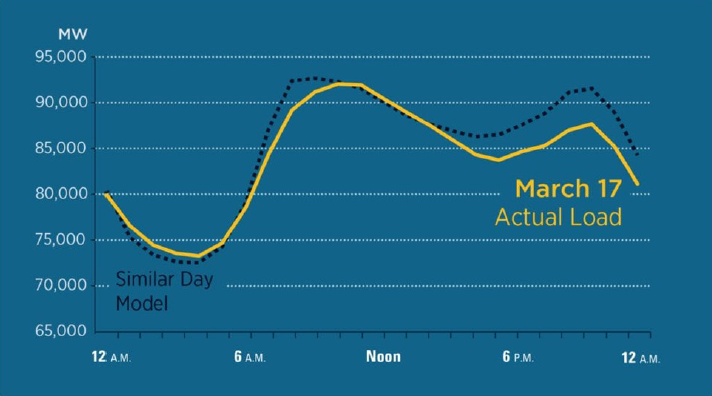

As recounted by UtilityDive’s Robert Walton on March 23, PJM expects that “[e]lectricity use will more closely resemble weekend days.” Indeed, the chart below from PJM Inside Lines on March 23 shows that evening-peak usage in PJM was 5% lower than expected on March 17. Walton also noted a decrease of 3-5% in demand reported on March 20 in ISO New England, whose operator had observed slower ramping levels in the morning. At the more extreme end of this spectrum, peaks in MISO for the month to date are down by 13% from the March average since 2014; MISO representative Allison Bermudez attributes the change not only to milder weather but also to “the pandemic-related closures and adjusted operating hours of non-critical businesses.” On the other hand, Walton reports that neither the Southwest Power Pool nor NYISO has witnessed a noticeable drop in its respective load, although both have observed shifts in usage patterns.

As long as coronavirus policy remains fragmented on a statewide and even citywide basis, the extent of these load drops remains to be seen. If entire regions or the whole country institutes a more significant shut-down, electricity curtailment could resemble that of countries such as Italy, whose peak demand plunged by approximately 20% a week after its lockdown went into effect.

President Trump has been adamant about his hope to return the U.S. economy to normal by Easter, so a federally mandated shutdown is not so likely. Then again, unlike China, the U.S. is still in the early stages of this ordeal. Official policy could still go through many changes.