PLAYING OFFENSE AND DEFENSE DURING MARKET TURMOIL

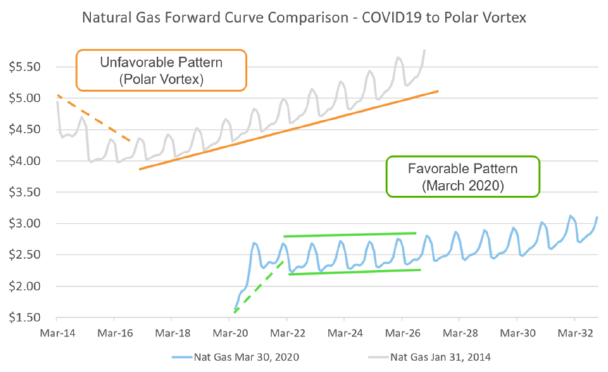

Current market conditions are obviously among the most challenging seen in a long time in light of the combination of higher and broad-based market volatility, liquidity challenges across many markets and sectors, and a deep sense that conditions will worsen before they improve. Such a foreboding economic atmosphere can naturally trigger a very defensive response from investors, but those same conditions can cre-ate opportunities to play some offense at the same time, too. Market players shrewd enough to see through the fog and go after them can reap some nice long-term bene-fits. A comparison of the NYMEX Henry Hub forward price curves for natural gas dur-ing the Polar Vortex in the winter of 2014 and today’s COVID-19 crisis (shown in the chart below) helps illustrate this point.

During that extreme-weather event six years ago, near-term forward prices pushed sharply higher than prices 1-3 years out before resuming their historically normal up-ward slope for several years forward. This pattern can yield missed opportunities in two ways. First, although conventional wisdom might be to chase rising near-term prices to lock in a larger share and avoid future risk, those who do so often overlook better price opportunities when near-term prices settle down. Second, although buyers might think to extend the time horizon for locking prices when forwards carry a dis-count (thereby reducing the average price paid over that period), they frequently fore-go longer-term opportunities by doing that.

The current curve is noticeably different from the one during the Polar Vortex but con-tains its own potential traps. Because near-term forwards are sharply lower than long-er-term forwards, one might see that seemingly steep forward premium for the first two years and instinctively want to avoid locking in those longer-term prices because they are “too high,” but this thinking is often misguided. Typically, the premium is so steep because the bottom fell out of the very front end of the forward curve, making it more likely that it will rise over time to more historically normal levels, as opposed to the back part of the curve coming down to meet it. Furthermore, the back part of the curve also tends to shift higher under those conditions. Therefore, as the difference between shorter- and longer-term prices narrows, prices rise across the board.

The current chaos features the best of both worlds, where not only nominal prices but also forward premiums are historically low. Consequently, a case can be made for taking larger and longer-term fixed-price positions. Making smart strategic decisions during the current volatility may prove quite beneficial when it ultimately passes.