OIL’S SLIPPERY FUTURE

Like every other sector, the energy industry is undeniably suffering during this overall decline in the global economy. For example, although renewable energy is already priced competitively—especially at this time of year, when the mild spring weather brings plenty of solar and hydro resources to bear on supply—layoffs and a lack of short-term investment are sure to have a measurable impact on its growth. Moreover, getting no financial support in the recent $2 trillion stimulus package certainly does not help.

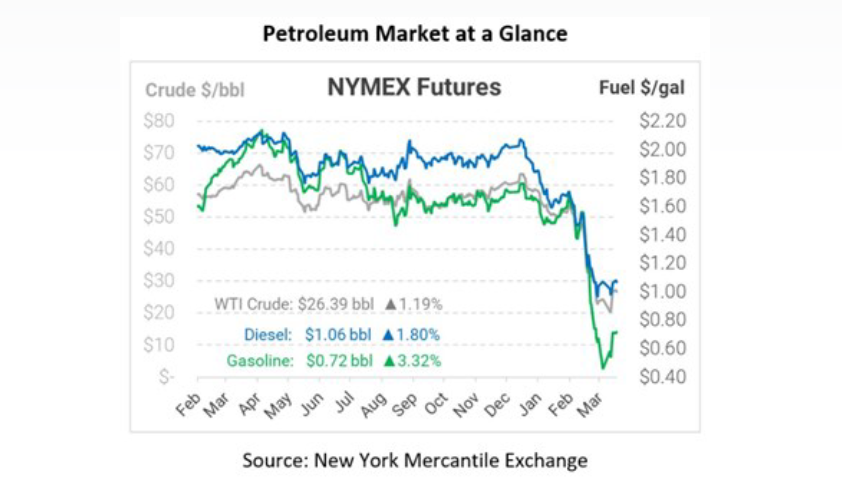

Nonetheless, the current corporate climate and international political pressure should ensure that these developments are no more than a speed bump for the green-energy market. Where the disruption appears far more impactful over the long term is the oil business. The artificial decrease in demand for electrical power imposed by the global pandemic is certainly a factor in oil’s current misfortunes but may be much less significant than the current price war among Russia, Saudi Arabia, and, to a lesser extent, the U.S. The large increase in production by these heavyweights, coupled with a similar drop in demand, has sent a shock through the system, as reflected in this year’s sharp plunge in NYMEX crude oil futures shown in the chart below from Mansfield.

Because the amount of available storage is already historically tight during the spring, the economic reasons to limit oil production keep piling up while meetings to discuss the matter are being delayed and fingers are being pointed on all sides. Some also suspect that Russia and Saudi Arabia are trying to make U.S. oil companies financially unviable. Whatever is fueling the tension, the status quo will only hurt American and foreign oil producers alike if OPEC and the other key producers cannot reach an agreement soon.

Amid the ongoing strain of low spring power demand and rumors of a potential tariff from the U.S. on petroleum imports, this price war is unlikely to continue much longer. How it ends could be extremely consequential not only for the broader energy industry but also for the entire world economy.