ENVIRONMENTAL UPSIDE AND DOWNSIDE TO CORONAVIRUS

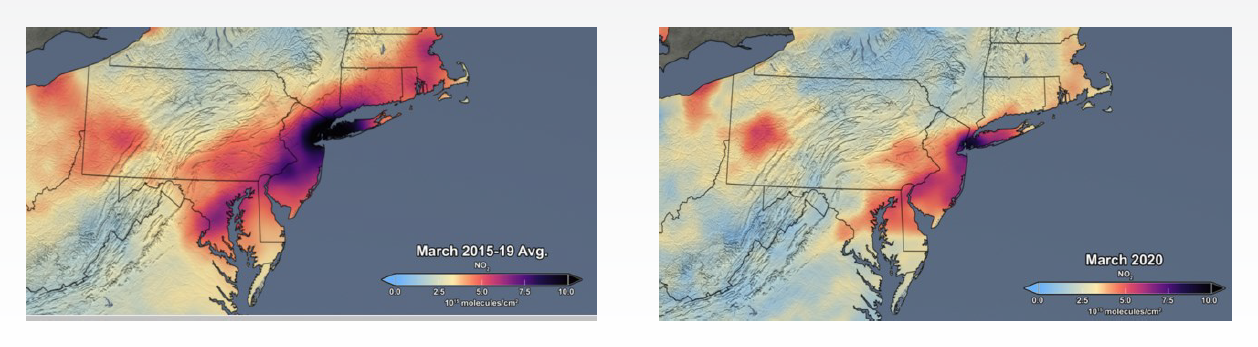

The coronavirus has completely disrupted everyone’s life but also yielded at least one arguably positive side effect: a significant decrease in fossil fuel consumption. As people across the U.S. continue to shelter in place, the resulting cutbacks in travel, industrial activity of all sorts, and electricity generation have reduced air pollution throughout the country. The images above from a posting by NASA on April 9 provide a compelling depiction of the drop in air pollution last month just in the Northeast. Comparing the rolling average of atmospheric nitrogen dioxide in the region for the month of March from 2015 through 2019 with the level in March 2020, they show an approximate 30% decrease over the stretch from Washington, D.C., to Boston.

Although the present situation is good news for the environment in the short term, history suggests that the fresher air may be rather short-lived. Of course, nothing in the past couple of decades perfectly replicates what is going on in America today, but the 2009 recession is somewhat instructive. Writing for E&E News on April 6, Benjamin Storrow notes, “In 2009, the Great Recession pushed global emissions down almost 1%. The next year CO2 levels rose by roughly 5%, as governments around the world enacted stimulus measures to prop up their economies.”

The country’s economic comeback from this pandemic has many unknowns, but, however it shakes out, emissions will surely rise again as people’s day-to-day lives slowly return to normal. Moreover, as with the previous recession, the rate of increase in emissions may outpace the eventual rate of economic growth. A staggered phase-in could lead the federal and state governments to loosen some environmental regulations to jumpstart companies, which could take advantage to save time and money, unless they were to adopt a more aggressive strategy with renewable energy to stand out to their customers.