WILL OIL LEAVE A SLIPPERY SLOPE FOR NATURAL GAS?

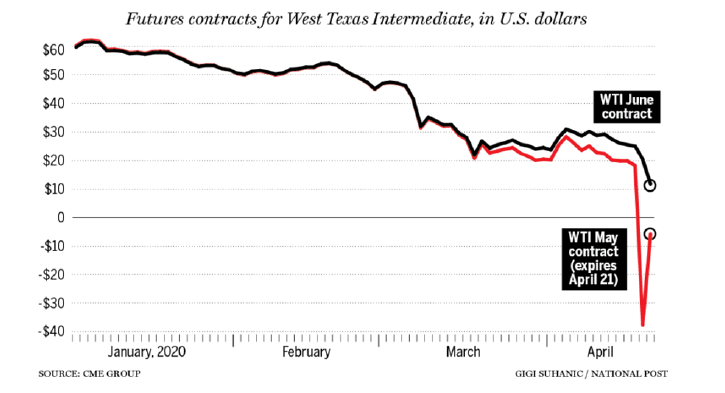

The big story in the markets this week is the freefall in world oil prices, exemplified by the plunge in the West Texas Intermediate (WTI) price of May futures to negative $35 per barrel on Monday (shown in the chart below from CME Group). As the coronavirus has dried up demand in a global market already oversupplied, in part, because of the now resolved feud between Russia and Saudi Arabia, traders unable to take physical delivery and lacking available storage were able to sell their financial positions only at negative prices. Against such a backdrop, those in the natural gas and power markets may wonder whether the decline of oil is going to take them down with it.

Fortunately, oil’s woes may not impair the price of natural gas or power produced from natural gas in the short run. If anything, natural gas prices may actually increase. Although natural gas has also suffered from a bit of a supply glut recently, demand for it and the electricity that it generates has not waned nearly as much as has demand for oil. Furthermore, because much of the natural gas produced over the last few years has been “associated” natural gas, produced as a byproduct of oil drilling, gas production should naturally pull back as market forces curtail oil production in the U.S. All else being equal, gas prices should then rise.

The biggest bump in gas and power prices is likely to occur later in the year. Of course, if industries remain shut down for the long haul, they may ultimately just retreat to a statistical average.