BLACKJACK: COAL UP IN ‘21

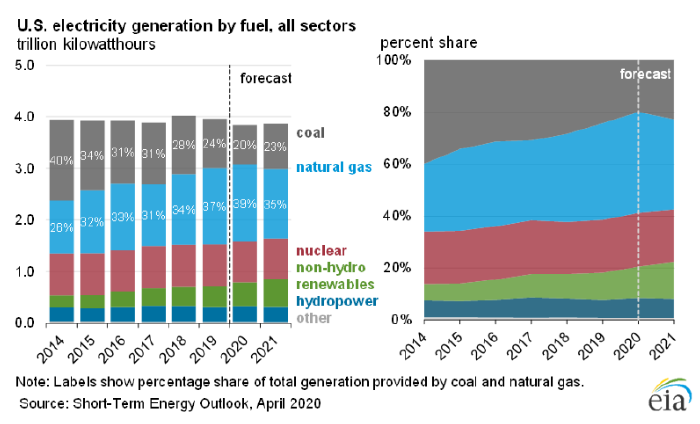

Coal is expected to have a slight resurgence next year. Amid the fallout from the coronavirus over the last couple of months, the U.S. Energy Information Administration (EIA), in the charts below from its Short-Term Energy Outlook for April, forecasts a rise in coal-fired generation in 2021, which would be the first in exactly 10 years.

As the general public has soured on fossil fuels, nearly half of the states in the U.S. have committed to decreasing their carbon emissions significantly over the next couple of decades. Aided by the proliferation of renewable energy sources over the last sever-al years, this movement has made inroads as coal’s share of the nation’s fuel mix has steadily declined since 2011. Therefore, green energy advocates might be understandably confused and dejected by the EIA’s new projection.

Fortunately, the seeming setback is more of a mirage. Both charts clearly show that, although coal is expected to contribute a larger percentage of U.S. electricity in 2021 than in 2020, the per-centage of electricity produced by renewables should also increase. Indeed, the entire “hill” comprising all non-carbon-based energy sources continues its upward slope.

Despite the projected incursion of coal, the EIA’s anticipation of continuing growth in green energy is a positive development in the short term. Nonetheless, disruptions in funding for new green infrastructure are a concern under current conditions. Taking a proactive stance on clean energy now could help companies avoid price spikes if its supply does end up shrinking.