SUMMER ENERGY DEMAND HEATING UP

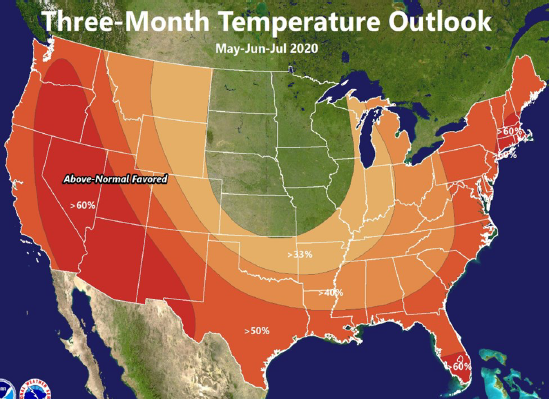

More states are slowly reopening their economies, and, as illustrated in the map below from the National Weather Service, temperatures are set to rise dramatically above norms in large swaths of the U.S. over the next three months. Against that backdrop, this summer’s energy usage should be much more comparable to last summer’s than this spring’s energy demand has been to that of spring 2019. In fact, some markets, such as ERCOT (where things have opened up much more and much earlier than in other regions), have actually expected their summer load to be as high as, if not higher than, their load in recent summers.

The current drop in America’s overall energy usage due to COVID-19 is well known. Indeed, amid all of the social distancing and the ensuing economic downturn, it was expected. As some governors tread lightly in their reopening efforts, it is reasonable to assume that certain bastions of economic activity, such as offices and retail stores, will not be quite back to normal by summer. Nonetheless, hotter weather should raise residen-tial electricity usage by a large amount throughout the country, especially if people continue to stay home much more than they normally would.

An important question is how this transitional period will affect electricity prices, which usually peak in summer because of higher demand. This summer, demand may ultimately be lower than usual, but supply should also be reduced, not only because of the shutdown of certain plants that were priced out but also because of declines in the amount of natural gas on hand due to ongoing curtailment of oil production. The effect will likely vary from market to market, but, in the end, this summer’s power prices could be much closer to historical summer averages than initially expected because of the pandemic.