CORE STRENGTH CAN SLIM DOWN YOUR COMPANY’S CAPACITY COSTS

With the dog days of summer basically already here, now is an ideal time for businesses in the Midwest and Northeast to avail themselves of Calpine Energy Solutions’ Capacity Obligation Reduction Effort (CORE) program. A completely voluntary program that runs each June 1 through September 30, CORE can help companies save money on their capacity costs in MISO, PJM, NYISO, and ISO-NE for next year.

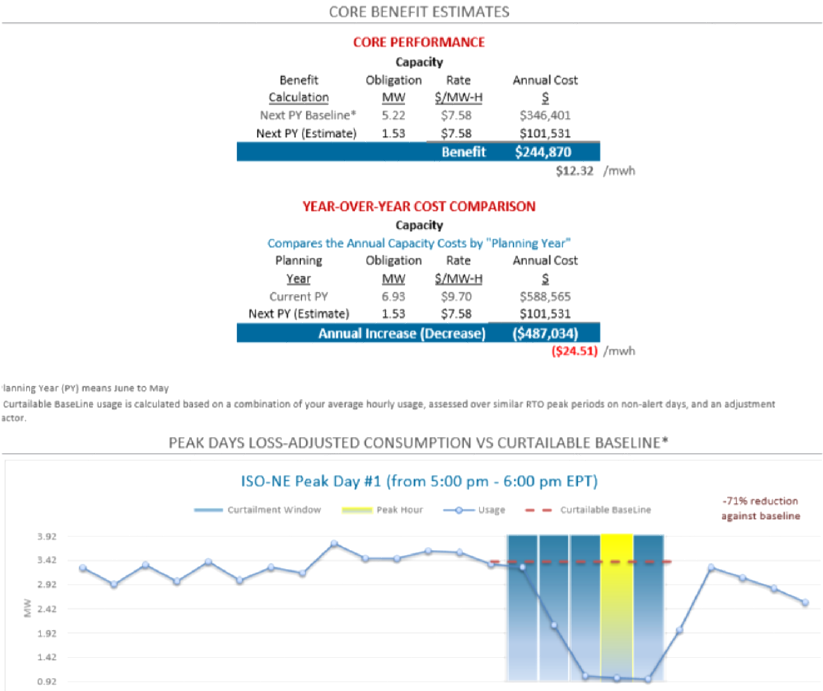

A consumer’s capacity charges in those regions are a function of not only local capacity auction clearing prices but also the consumer’s peak load contribution (PLC), effectively its share of the total system load during the peak-load hour of the peakload day of the preceding year. (PJM considers the peak-load hour of each of the five highest peak-load days of the previous year.) Therefore, if a company is able to lower its PLC, the resulting reduction in capacity costs will be reflected in its electricity invoices for the next planning year.

Calpine Energy Solutions’ CORE team helps customers maximize their opportunities for such savings by using its sophisticated forecasting system to notify them of potential peak-load days, sometimes days in advance. Each notification suggests a specific date and hours for power curtailment, tailored to each customer’s unique circumstances. With the CORE team’s expert insight, a customer can then curtail its energy use however it sees fit, whether by turning some lights off, raising the thermostat setting, or shifting production outside peak hours. Then, after the ISOs publish their system peaks, Calpine Energy Solutions, for those customers that would like it, will issue a “SCORE Card” like the above image, which provides an estimate of the annual capacity savings achieved.