POWER MARKETS

WEST California’s grid looks in better shape but continues to need flexible capacity during the nightly ramp. Imports from Arizona and Nevada have been limited by daily temperature highs hovering around 110 degrees in Phoenix and Las Vegas. Fortunately, the Desert Southwest is projected to cool down by the weekend and should be able to provide SP15 more mega-watts at its disposal to decrease volatility in the nightly ramp. Throughout August, Day Ahead prices have averaged $82.54/MWh and $30.91/MWh in SP15 and Mid-C, respectively.

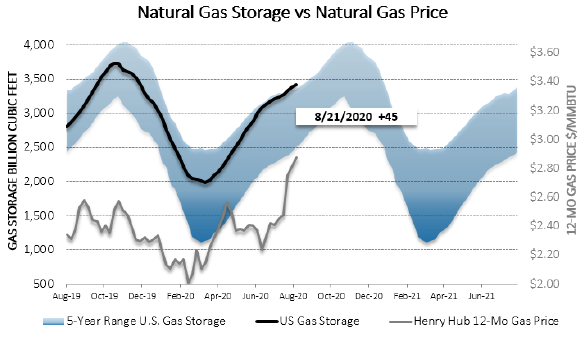

ERCOT Aided mainly by the continuing rally in natural gas, term prices climbed slightly this week. Real-time prices have been mostly moderate, aside from a few triple-digit intervals during the super-peak hours. The ORDC adder for the month is still under $10/MWh, well below the average of $46/MWh for last August.

EAST In MISO, the hot weather on Monday cranked demand up to 116.8 GW, a new peak for the year to date. Over in PJM, today’s demand appears similarly on track to place in the top five peaks of the year. However, despite some of the highest temperatures of the year, prices have remained stable across all regional ISOs, both DA and RT prints averaging in the $20s/MWh.