POWER MARKETS

WEST The drop in peak temperatures over the past week corresponded with de-creasing volatility in spot prices. Day Ahead prices in SP15 and Mid-C averaged $41.13/MWh and $24.71/MWh, respectively, over that period. However, because the Pacific Northwest is projected to receive the brunt of this weekend’s heatwave, flexible hydro exports to California could be curtailed to increase volatility during the nightly ramp as California scrambles to find flexible power from an alternate resource.

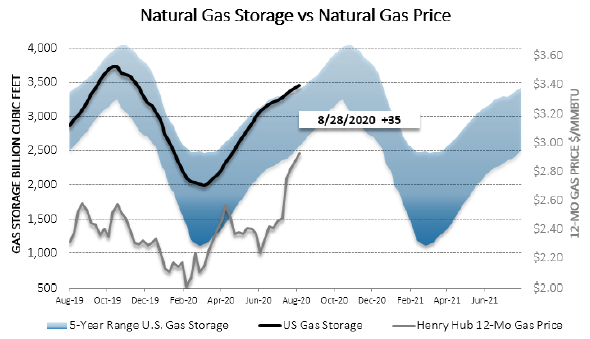

ERCOT Term prices were mixed over the past week as the back of the curve saw declines related to natural gas prices. Prices did rise, albeit slightly, with natu-ral gas prices for CY2021. Real-time prices have been rather volatile this week, particularly in the super-peak hours, because of consistent cooling demand. ATC averages for August in Houston and the North Load Zone were just above $34/MWh, well below the $130/MWh average of 12 months ago but well above the averages for the past 10 months. The ORDC adder settled just under $10/MWh for August.

EAST Capacity prices in ISO-NE continue to fall. In the most recent Annual Recon-figuration Auction (ARA) for Planning Year 2021/2022, additional supply cleared at a price substantially lower than at the last auction for that planning year, reducing its overall capacity price. Planning Year 2021/2022 is subject to yet another ARA before it begins. Absent any reversal in price trend at that auction, customers who elected to pass through capacity are sure to benefit from the lower capacity costs.