NUCLEAR POWER FACING THE NUCLEAR OPTION

When Treasury spreads turned negative last summer, financial mar-kets sounded the alarm that recession was imminent. Some ques-tioned the validity of those fears at the time, but those concerns ulti-mately proved right, although the timing was off.

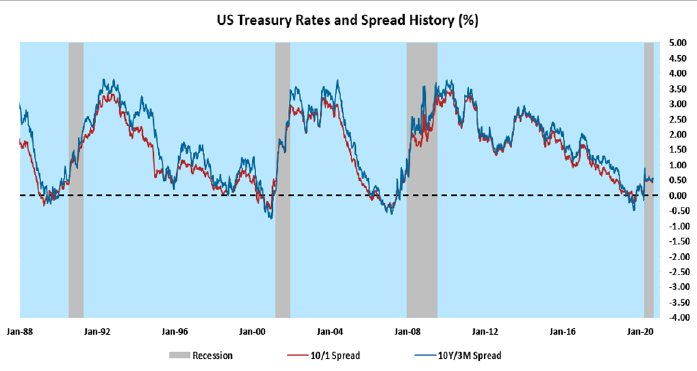

That anxiety was rooted in a pattern, dating back to the 1960s, where negative Treasury spreads consistently preceded recessions, as de-picted in the chart below. A year ago, no other economic data points indicated recession, but, in fairness, such negative spreads have his-torically preceded downturns by an average of 8-12 months—provided that they lasted for a long enough period of time. Thus, the question was whether last summer’s spreads had been negative long enough to serve as a credible warning. Of course, “long enough” is clear only in hindsight, but it turns out that they had been. However, the current recession was finally triggered not by typical economics but by the COVID-19 lockdowns.

Because this recession, which officially started in February 2020, is technically still ongoing (despite many economic metrics showing signs of improvement), the big questions now are when it will end and whether Treasury spreads can offer a clue. Typically, after going nega-tive, spreads turn positive at the beginning of a recession and grow increasingly positive, on average, for several months before the end. At the end of each of the last two recessions in 2001 and 2009, spreads ranged from 2.5% to 3.0%. On the other hand, they were only around 1.5% at the end of recessions prior to 2001, mainly because short-term interest rates back then were well above zero, unlike what they have been in the last dozen years.

Holding near a paltry 0.5%, current spreads are a long way from either of those trends. Unfortunately, this suggests that the light at the end of the tunnel could still be several months away, so the remainder of this unforgettable year of infamy is likely to stay rough. In any event, Treasury spreads appear to be a key indicator in determining whether next year is more mundane, as everyone hopes. Once they widen out enough, brighter days should be ahead for the U.S. economy.