THE SUN KING

Although the world’s love affair with renewable energy has been growing for some time and for obvious reasons, not all of its forms get the same love. For example, hydropower has long been the most plentiful source of renewable electricity but may soon yield that distinction to solar power. In fact, the International Energy Agency just dubbed solar “the new king of electricity” in its latest World Energy Outlook.

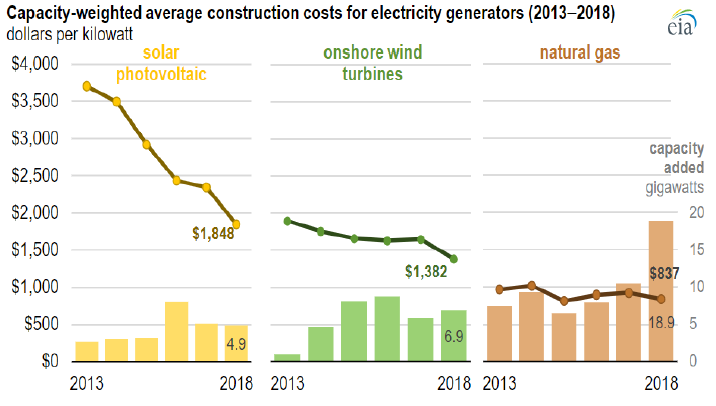

The acclaim is due to the substantial improvement in the ability of solar facilities to compete with and beat old “king” coal in pricing. The real game changer is the rapid decline in solar construction costs relative to those of other resources, as shown in the graph below from the U.S. Energy Information Administration.

Moreover, solar power is poised to grow only more powerful. Improvements in battery technology continue to help large-scale solar panel installations, and, in the U.S., FERC Order 2222 will only incentivize the proliferation of smaller-scale solar aggregation as well. In turn, because such microgrids can be located closer to areas with less generation, congestion costs should fall.

Of course, this and other emergent technologies are currently un-able to meet capacity requirements on their own, so their growth runs the risk of increasing capacity costs as the more dispatchable types of resources increasingly go offline. Nonetheless, as the solar revolution makes clear, renewables themselves are becoming more cost-effective and should drive electricity prices down in the long term, but growth in their supporting technologies is key to limiting price volatility. Ever on alert, Calpine Energy Solutions will always be ready to take advantage of the latest innovations to help companies limit their exposure.