STIGMA FACING ENERGY INDUSTRY ENDURES

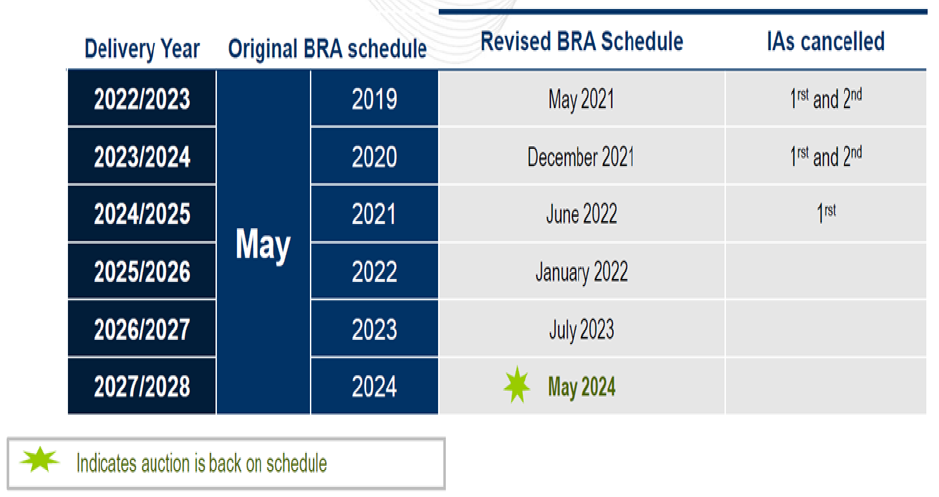

Now that FERC, as reported on October 15, has blessed PJM’s expanded Minimum Offer Price Rule (MOPR-Ex), which should allow most, if not all, existing and new state-subsidized resources—such as onshore wind, solar, nucle-ar, and demand-side facilities to be able to clear the PJM capacity auction, PJM has announced the return of its capacity auction, also known as the Base Residual Auction (BRA), after a two-year hiatus. The new schedule for the next six BRAs is shown in the table below from PJM.

FERC had ordered the suspension of the BRA because it had deemed PJM’s capacity market increasingly untenable in light of state subsidies for preferred resources. Although the debate will likely continue over how MOPR-Ex will frustrate some states’ climate policies, FERC’s imprimatur means that the auction will again be able to restore some stability to wholesale capacity prices in PJM.

Because of current excess capacity in PJM, capacity prices in the RTO are not expected to be largely affected by this development in the near term. Nonetheless, market operators are sure to welcome this news, for the forward price signals and capacity commitments yielded in the auc-tions help participants make more informed investments in their generation resources, ultimately benefiting ratepayers.