POWER MARKETS

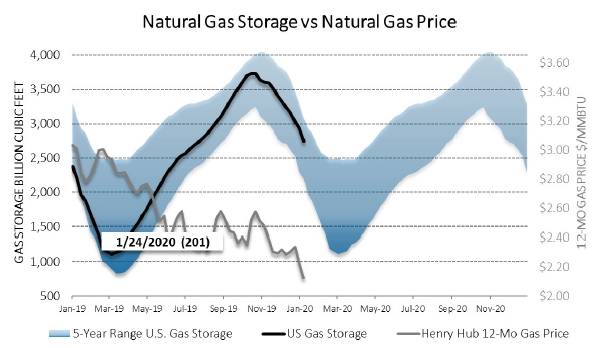

WEST As January comes to a close, the above-average tempera-tures, expected to continue through February, and strong snowpack continue to drive forwards down. The downturn in heating demand has considerably relaxed demand for natural gas and consequently softened spot prices over the past week.

ERCOT With mild winter weather across the state, 7x24 real-time prices look to settle at an average of $16/MWh for January across all zones except the West Load Zone, where congestion has yielded an average of $22/MWh for the month. The ongoing collapse in front-month natural gas prices continues to take its toll on 7x24 forward prices. Since the beginning of November, when NG prices began their descent, forward prices are down by approximately $2.50/MWh.

EAST Prices have come back down from the jump seen last week. Both DA and RT prices in the main trading hubs in PJM, MISO, ISO-NE, and NYISO have averaged from the high teens to the low $20s/MWh for the week with minimal DART spreads.