RATE CUT TO TREAT THE CORONAVIRUS?

With the CDC reporting COVID-19 infections across more than 50 locations worldwide, panic has spread even more virulently through financial markets. The S&P 500 index is down approxi-mately 9% from its highs and oil has dropped below $50 per barrel as new quarantines, flight bans, and travel advisories are an-nounced daily. As reported here last month, United Airlines, Dis-ney, Apple and other companies have announced potentially ma-terial impacts to earnings as a result of the virus with additional corporate warnings having been issued since.

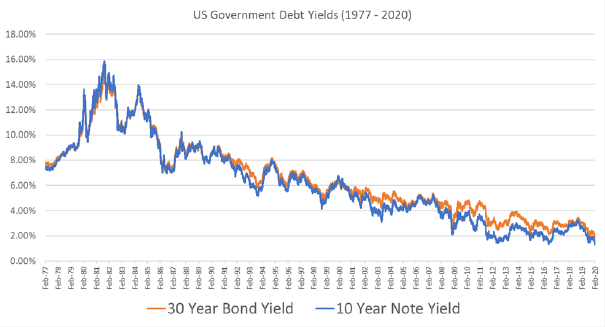

But while stocks and energy prices are cratering, bond prices are rallying. When bond prices go up interest rates go down and some interest rates are now at record lows. As depicted in the chart below, yields on 10 year US Treasury notes hit a record 1.31% and 30 year Treasury bonds set their own record low yield of 1.79%.

Although lower interest rates mean lower borrowing costs for the US government, they also indicate fears of an impending reces-sion. Indeed, despite the persistently low unemployment rate and many other economic indicators that have recently shown strong readings for the U.S. economy, the CME Group’s FedWatch Tool - a barometer of bond market expectations - projects a greater than 95% chance that the Federal Reserve will cut its benchmark inter-est rate by the end of the year. Central banks around the world stand ready, and are in fact expected, to ease monetary policy in continuance with the oversized role they’ve played in financial markets since the 2008-9 financial crisis. Unfortunately this crisis is different from other financial crises as it cannot be resolved with monetary tools. With any luck a robust response from govern-ment, scientific, and healthcare organizations will limit further im-pacts from the virus.