ANOTHER SCORCHING SUMMER, ANOTHER ENERGY EMERGENCY

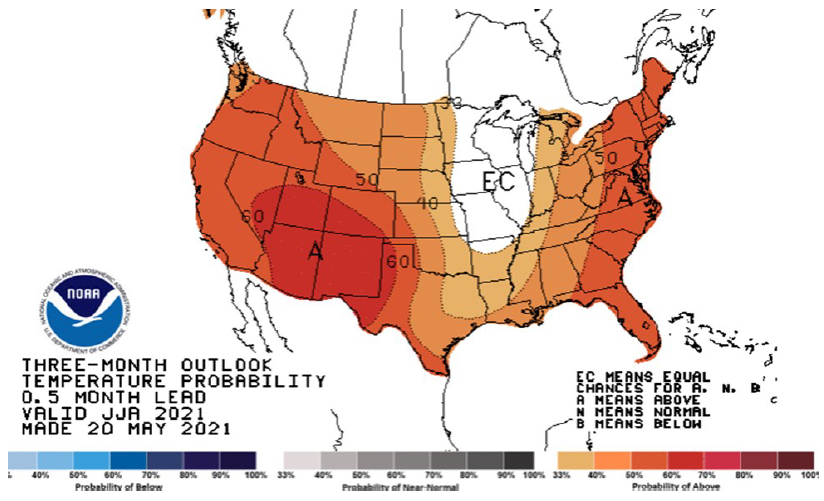

As shown in the map above from the National Oceanic and Atmospheric Administration, this summer is projected to be hotter than usual in most of the U.S. Aware of the struggles that the nation’s electric grids will likely encounter during such sweltering weather, the North American Electric Reliability Corporation has warned several regions—including California, Texas, New England, and parts of the Midwest—that they are most at risk of facing energy shortfalls during the summer.

This development is hardly news to some extent. California, for example, is known for its problems with meeting the evening demand peak after the daily drop-off of solar output over the years and is already dealing with another year of less-than-average hydropower. Nonetheless, predicaments such as these demonstrate not only that states are slowly but surely learning to adapt to the new renewable-energy landscape but also how volatile that environment still is.

Further complicating the situation is the continuing rollback of COVID-19 restrictions, which makes the extent of electricity demand recovery hard to predict. In any event, the economy is bound to be much more open this summer than last summer. Indeed, the U.S. Energy Information Administration has predicted that summer electricity consumption should increase by 1.5% from 2020.

With the usual summertime increase in demand, energy prices are already poised to rise, but, amid energy supply struggles like those in California, all bets are off. Suffice it to say that companies can reap tremendous benefits by assessing (or reassessing) their energy costs and risk tolerance in advance. Fortunately, Calpine Energy Solutions specializes in exactly that.