U.S. NATURAL GAS EXPORTS EXPLODE

The U.S. natural gas sector has enjoyed quite the boom this year. The U.S. Energy Information Administration (EIA) reported last month that, in June, pipe-line exports to Mexico to support that country’s industrial base and electricity generation peaked at 7.4 Bcf/day and exceeded the monthly average of the previous five years by 44%. Furthermore, overseas shipments of U.S. liquefied natural gas (LNG) hit record levels in the first half of 2021 to average nearly 10 Bcf/day after benefiting from relative misfortunes in Asia and Europe.

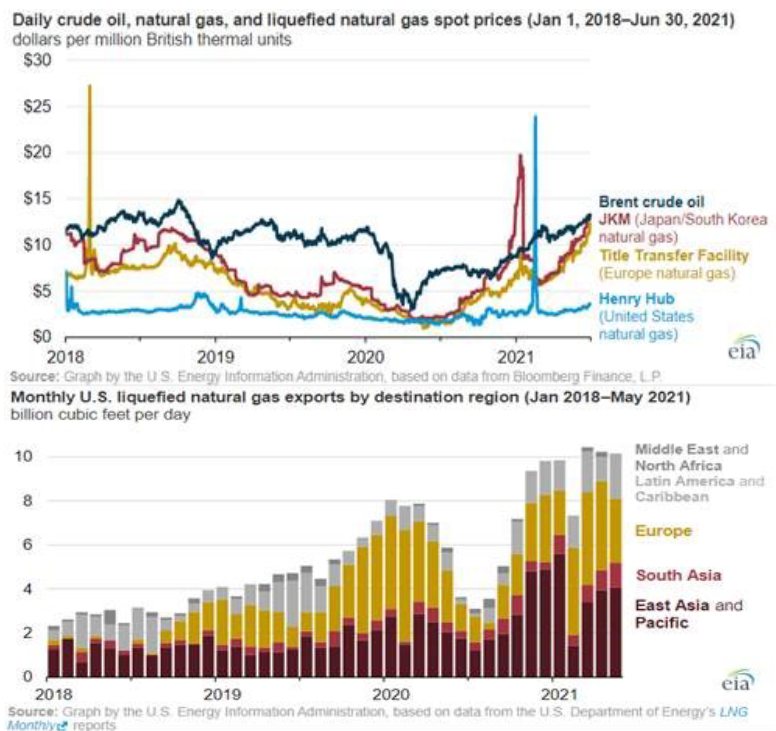

Not only did abnormally cold winter weather in both of those continents eat into their respective inventories, but an unusually warm spring in Europe, which places great emphasis on renewable energy, also raised demand for natural gas for backup generation to keep its grids balanced. As the graph from the EIA below makes clear, the resultant spike in spot LNG demand in Asia and Europe has raised regional natural gas prices so much that U.S. (Henry Hub) natural gas has become much more economically attractive.

Given the major investments by U.S. producers to expand export capacity over the last five years, these strides were not unexpected. Indeed, exports have accounted for more than 15% of domestic production so far in 2021, contributing to price increases for the commodity in the States.

Ironically, these developments are a testament to the ongoing need for natural gas as the unsung hero enabling global efforts to decarbonize, for it continues to play an outsize role in counterbalancing the variable output from wind and solar generation facilities. Although key advancements have been made in large-scale battery storage technology, natural gas remains indispensable to global energy security for the time being.