POWER MARKETS

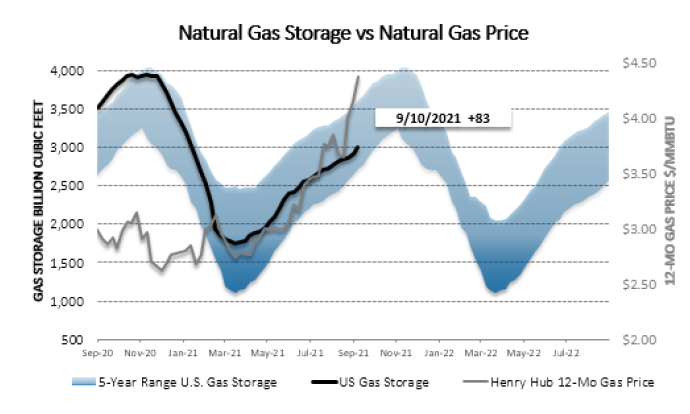

WEST Over the next 10 days, temperatures are expected to be only slightly above normal, so demand should stay on the decline as summer draws to a close. Day Ahead prices for the month to date are averaging $74/MWh and $70/MWh in SP15 and NP15, respectively, and should continue to enjoy support from strong natural gas prices at Henry Hub and SoCal Citygate for the foreseeable future. Term prices have also responded to the bullish natural gas market and to carbon prices, which have risen as demand for California Carbon Allowances is expected to materialize from increased deployment of gas-fired power plants and the rebound in other economic activities producing incremental emissions. CY2022 is up by more than $10/MWh over the past week.

ERCOT Despite mild weather, reduced loads, and ample available generation, 7x24 real-time prices remain relatively strong, averaging around $42/MWh for the month to date. Buoyed by robust natural gas prices, peak hourly real-time spot prices have reached $60-$70/MWh amid unimpressive loads and are likely to stay elevated through the upcoming fall and winter months if corresponding forward natural gas prices for that period hold around their current level of $5.50/MMBtu. If winter loads are sizeable, prices could rise even higher, for higher heat rate units would be at the margin. Accordingly, forward prices are also up on the surge in the winter gas strip for November through March. Indeed, the CY22 7x24 strip is up by almost $4/MWh from last week, whereas CY23 and beyond are up by less than $1/MWh.

EAST Midday peak prices have climbed consistently since last week. Warm weather explains the increase on Monday and Tuesday in PJM, where Day Ahead reached $145/MWh. That development, combined with the ramp-up of outage season, left a short supply stack to power the grid throughout the Northeast. Because of a failure of congestion to materialize as expected in ISONE’s Real Time market, some price separation emerged among various zones in its Day Ahead market yesterday. The biggest Day Ahead spike occurred in NEMA, where prices hit $154/MWh.