WARY OF A WINTER WONDERLAND FOR ENERGY PRICES?

Although, on average, index electricity prices continue their steady climb from a year ago, the trend is slowing as forecasts showing a relatively mild winter throughout most of the U.S. have essentially decoupled Henry Hub natural gas prices from those of Title Transfer Facility, the main European gas hub. However, the U.S. is not without risk.

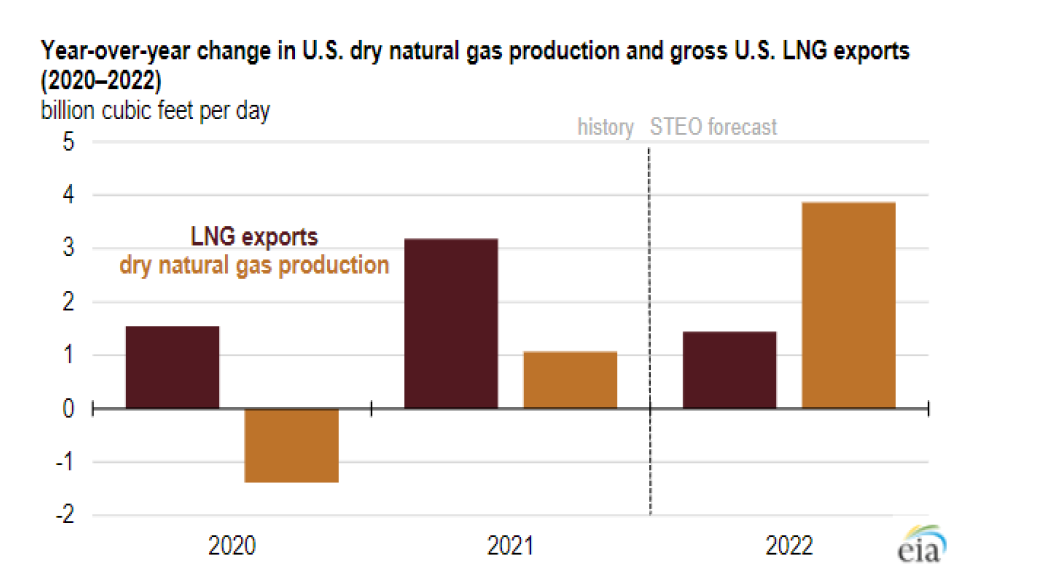

The graph below from the U.S. Energy Information Administration shows that the U.S. remains a net LNG exporter for 2021, meaning that, on balance, more natural gas is being sent abroad than kept stateside. As long as predictions of a relatively warm winter prove accurate, that deficit will not be a problem, but natural gas prices—not to mention energy prices in general—will surely spike again if this winter turns out to be a frigid one and not enough gas is on hand to cope.

While circumstances still look promising, companies should take advantage of the current tameness in gas and electricity prices to assess their portfolios and find out how Calpine Energy Solutions can help minimize the downside of a potential downturn in the winter outlook..