PANDEMIC NOT SLOWING THE GREEN REVOLUTION ANYTIME SOON

As the pandemic introduced multiple unforeseen challenges to global markets last year, many companies had to scramble to adapt to a business climate changing constantly. One might think that, amid the economic turbulence, they would sacrifice lofty priorities such as renewable energy, but the numbers prove otherwise.

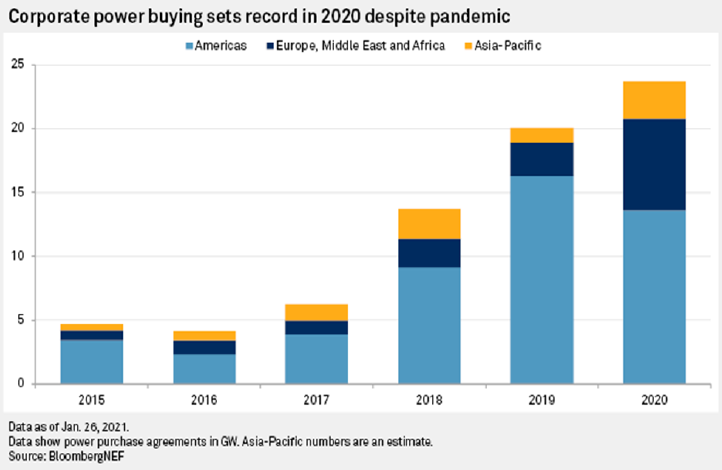

Camilla Naschert of S&P Global Market Intelligence reported last week that, in 2020, more than 130 corporations spanning various sectors around the world entered into their own power purchase agreements to procure a record total of 23.7 GW of wind and solar power. Indeed, the chart above from research firm BloombergNEF shows that, although corporations in the Western Hemisphere did purchase less green electricity than in 2019, those in the Eastern Hemisphere actually recorded their largest renewable-energy purchases of the last six years by far.

The resilience of this push toward renewable energy demonstrates the power of stakeholder emphasis on sustainability. Because customers and employees, in addition to shareholders, are placing so much value on sustainability, management and directors are increasingly recognizing the need to reduce their carbon emissions and footprint. Consequently, corporate initiatives to become carbon-neutral continue to spread. As Kyle Harrison of BloombergNEF observed, “To not only maintain, but grow, the clean energy procure-ment market under these conditions is a testament to how high sustainability is on many corporations’ agendas.”

Moreover, companies’ clean-energy commitments are poised to remain big for the foreseeable future. Naschert reported that, last year, approximately 65 new companies joined the RE100 pledge to offset 100% of their electricity usage with clean energy, which, according to BloombergNEF, will require 93 GW of additional renewable-energy purchase contracts. Clearly, the current strength of the market for renewables during these trying times signals even better times ahead once the broader economic challenges have eased.