NO SUCH THING AS “TOO MUCH” ENERGY STORAGE

A common refrain in the debate over how to meet future global energy needs cleanly is the importance of energy storage. Indeed, the International Energy Agency (IEA) declared last November in its Energy Storage tracking report that, to realize its Net Zero Emissions by 2050 Scenario, worldwide energy storage capacity needs to grow by approximately 38% annually between now and then.

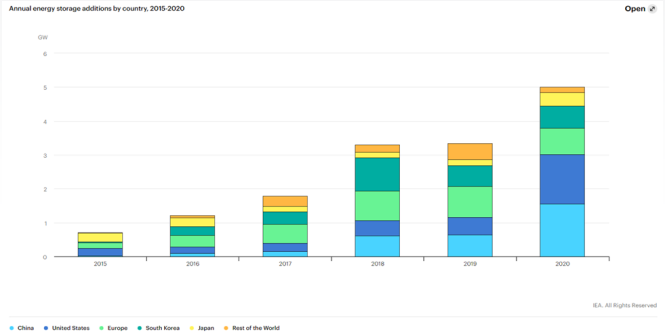

Not surprisingly, that gap is being bridged largely with battery technology. The graph below from the IEA illustrates that, in 2020 alone, global battery capacity increased by 5 GW to a total of 17 GW. China and the U.S. led the way in energy storage additions that year and have not stopped there. China is planning to install more than 30 GW of further storage infrastructure by 2025, and the U.S., through the Better Energy Storage Technology Act, has earmarked more than $1 billion over five years to support development of the technology.

Even individual states have emphasized storage solutions in their respective green-energy strategies. The National Conference of State Legislatures notes seven states whose procurement targets require the integration of storage technologies. Most recently, for example, Virginia enacted legislation mandating that its utilities acquire a combined 3,100 MW of new energy storage by the end of 2035. Moreover, motivating renewable generation, which absolutely needs to be coupled with storage options to offset its intermittency problem, is not the only priority for some states’ embrace of energy storage; after the havoc wreaked by Winter Storm Uri on its grid a year ago, Texas is considering such innovations for short-term grid reliability during emergencies.

Of course, the attention that batteries receive in this conversation should not overshadow the contributions of other, more time-tested energy-storing technologies, such as pumped hydroelectric capacity, compressed air, flywheels, and thermal energy storage. In fact, the U.S. Department of Energy observed that, as recently as March 2018, 94% of all stored energy capacity in the U.S. was in the form of pumped hydroelectric capacity. Certainly, any and all methods to store energy will be needed and welcome to achieve a greener energy future in the most economically sound way.