POWER MARKETS

WEST Snowpack and drought conditions in California are poised to worsen if precipitation in the Golden State proves as scarce as predicted during the 1-to-15-day forecast period. Meanwhile, the fear premium in the Q3 2022 forward curve remains formidable as hydro generation is projected to be below average and a heatwave is expected to span the entire West Coast this summer to squeeze supply while swelling demand across the Western Interconnect.

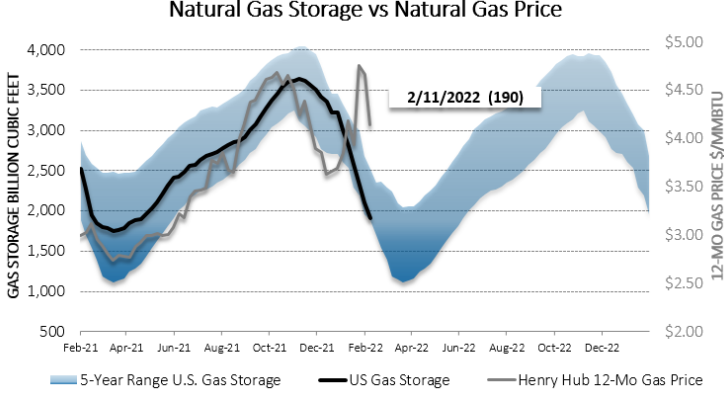

ERCOT Real-time prices have settled in the low $30s/MWh this week, save a few intervals when they went as high as $250/MWh and as low as $-20/MWh. They should be pretty low for the balance of the month, although the weather is forecast to turn colder near the end of February and into March. Thanks primarily to surging natural gas prices, term prices not only in the front month but also out into 2025 have rebounded sharply. Storage balances are adequate for now, and drought conditions in South Texas are tame, whereas both North and West Texas have had quite the dry winter.

EAST With the respite of warmth amid the brutal cold last weekend in the Northeast, prices dipped significantly at the beginning of this week. They did rise again later on but remain lower than last week. By region, prices remain highest in ISO-NE’s Mass Hub, where both Day Ahead and Real Time are averaging $103/MWh this week. In NYISO’s Hudson Valley and NYC, Day Ahead prices have been around $80-$90/MWh while Real Time prices have been closer to $100/MWh. Prices have been much lower in MISO’s Indy Hub and PJM’s West Hub, where Day Ahead and Real Time have been in the mid-$40s/MWh.