POWER MARKETS

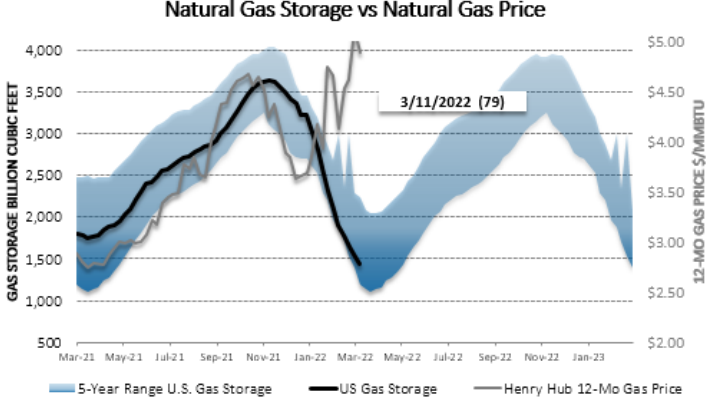

WEST Fundamentals are changing across the Western Interconnect as winter concludes. Thanks to robust precipitation in the Pacific Northwest over the first half of this month, hydro generation there from May through July of this year is now projected to increase by approximately 4 GW from the same period last year. Together with the approximately 1.5 GW of battery storage installed since last August, this boon will mean not only more capacity available during Q3 2022 than in Q3 2021 but also less demand for expensive natural gas facilities during the nightly ramp. Nonetheless, the forward market has stayed elevated because of volatility in the forward curve for NYMEX natural gas due to the glaring macro issues of the past few weeks.

ERCOT Resilience in natural gas prices is buoying term prices, which are approximately $2-$3/MWh higher than last week, depending on the term. With some triple-digit figures in the evening-ramp hours, real-time prices for the month are averaging in the mid-$30s/MWh, more than $10/MWh higher than the average for March 2021. The ORDC adder for the month has been minimal.

EAST Prices in ISO-NE are finally on par with those of the other regional ISOs. In both ISO-NE’s Mass Hub and NYISO’s Hudson Valley, Day Ahead averages are in the high $50s/MWh. For the former, that represents a drop of almost $24/MWh from last week, and the Real Time average in ISO-NE is right on top of Day Ahead with almost no DART spread. NYISO’s Real Time average is a bit higher at $64/MWh. Meanwhile, Day Ahead and Real Time averages are in the high $40s/MWh in PJM’s West Hub and the mid-$50s/MWh in MISO’s Indy Hub.